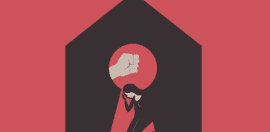

We cannot address domestic violence without acknowledging financial abuse

18 March 2021 at 7:00 am

What does this mean for banks and other financial service providers? Bruce Argyle from Bendigo Bank shares his insights.

International Women’s Day is an important opportunity to acknowledge how far the fight for women’s equality has progressed. However, it also provides pause for thought about the barriers that many women in Australia and the world continue to face.

The recognition of Grace Tame as Australian of the Year for her work in giving a voice to survivors of sexual abuse, the rise in domestic violence related to COVID-19 lockdowns and the poor representation of women in corporate Australia’s boardrooms and leadership teams highlight that we still have some way to go until equality between men and women is achieved.

One area that stubbornly remains unsolved is the alarming rate of domestic and family violence, which disproportionately affects women. Last year, domestic violence claimed the lives of 56 women – more than one woman per week on average. The murder of women – often at the hands of their current or former partners – is the most visible part of what has often been a longer period of abuse and coercive control. This is a key reason why advocates in Australia are pushing for the criminalisation of coercive control, like what is in place in the UK and Ireland.

Our staff not only witness some of this coercion, but also play an important role in identifying and preventing it. A key part, but little-known factor in domestic violence and controlling relationships is financial abuse. According to the Australian and New Zealand Journal of Public Health, more than one in seven Australian women have experienced financial abuse in an intimate partner relationship.

Financial abuse can take many forms. It can involve controlling spending and denying access to money or earned income, to running up debts on joint credit cards and taking out secret loans in a partner’s name. At its core, financial abuse is a method of control and is a powerful way of keeping someone trapped in a relationship by making them financially dependent and undermining their ability to safely leave.

With financial abuse playing such a key role in violent and controlling relationships, we will never solve the domestic violence problem in our country, unless we are able to not just recognise financial abuse, but also help survivors to be financially resilient.

But financial abuse is more difficult to detect than many realise. A key reason for this, highlighted by RMIT researchers in 2016, is awareness – many people don’t know that what they are experiencing is financial abuse.

While social, health and financial services could all play a role in screening for warning signs, what does this mean for banks and other financial service providers? As a bank, we have some insight.

The bank has long been committed to exploring ways to identify financial abuse and to assist any impacted customers. We continuously work with the Australian Banking Association (ABA) to update and implement a range of practices that will better support customers who may be vulnerable to financial abuse.

For us, educating staff in how to recognise the warning signs for financial abuse is an important first step. It might include seeing or hearing a customer taking instructions from another party, or remaining silent while someone else does all the talking. It might be as obvious as appearing fearful, unfocused, or withdrawn, or show when a customer doesn’t understand or is unaware of recent transactions on their account. It’s also important to recognise that statistically, it is possible some of our own staff are experiencing financial abuse. Providing support to staff experiencing financial abuse or domestic violence (including through paid domestic violence leave) is vital.

But screening for financial abuse is just the first step. We can’t hope to break the cycle of domestic violence unless we get the next step right: helping survivors to be financially independent and financially literate. This requires close collaboration between financial providers, regulators, support service providers and government. If we want to design the best solutions for survivors, we must break down the barriers between these players with a shared goal in mind.

Options might include understanding that the person experiencing financial abuse might not have access to their financial records and other important documents, providing victims with information on how to set up accounts in their own name, changing authorities on joint accounts to “both to sign”, not disclosing personal information with other account holders such as new addresses and other new contact details and foregoing any requirement for the customer to have to make direct contact with their abuser.

In addition, last year we announced the bank is playing a role in an important collaboration with Victoria Police and other participating institutions to identify more effective ways to protect the elderly and vulnerable members of our community. This is an example of our approach to ensure every single customer’s wealth and financial wellbeing is protected and supported, no matter their financial situation or where they reside.

In this changing environment, it’s even more important to remain vigilant to the needs of our most vulnerable, or those who become more exposed to financial abuse as a result of extreme events such as large-scale bushfires and pandemics, and to make sure the right safety frameworks are in place to support them in whichever way they engage with the bank.

Working together, a more holistic response that includes tailored financial products and policies, social and support services and legislation to support survivors to be financially resilient can be created. In turn, we will not only weaken the grip of domestic violence on Australia, we will build a more financially prosperous and resilient community.

If you or someone you know is experiencing domestic violence, you can phone 1800RESPECT, a 24/7, confidential information, counselling and support service. If you are in immediate danger, call 000 for Police and Ambulance assistance.